Executive Certificate in Sustainable Finance & ESG Analytics

This is the FIRST executive certificate program launched for executives among higher education institutions in Greater Bay Area (GBA), which will be aligned with the Certified ESG Analyst® (CESGA) global certification.

This comprehensive program aims to equip students with a deep understanding of the evolving needs of capital markets concerning Environmental, Social, and Governance (ESG) factors and Sustainable Finance. It provides foundational knowledge and practical skills in using cutting-edge data analytics methods, including Machine Learning techniques and Big Data analysis, to support Green Financing and ESG analysis, enabling effective ESG integration into investment decision-making processes, risk assessment, and portfolio management. Through real-world case studies and an exploration of the regulatory landscape, students will develop the necessary expertise to drive the transition towards a more sustainable and responsible financial system, positioning themselves as leaders in creating long-term value for investors and society.

Upon successful completion of the course, students will be granted the Executive Certificate in Sustainable Finance and ESG Analytics jointly offered by Lingnan University (Science Unit) and Friends of the Earth. Also, students are eligible to claim for Continuous Professional Development (CPD) hours with their respective professional institution that they are affiliated with.

Maximum HK$10,000 Subsidy

Name of Programme Provider: Lingnan University | Friends of the Earth (HK) Charity Limited

Programme Identification Code: GTP-254234

Programme Name: Executive Certificate in Sustainable Finance and ESG Analytics

This programme is one of the Eligible Programmes under the Pilot Green and Sustainable Finance Capacity Building Support Scheme, (https://greentalent.org.hk/).

The Scheme provides training subsidies to Hong Kong residents who are market practitioners and prospective practitioners of green and sustainable finance, namely students and graduates in relevant disciplines.

After completing Eligible Programmes, applicants can apply for a subsidy of up to 80% of the relevant fees (full-time student applicants can apply for a subsidy of up to 100% of the relevant fees), subject to a ceiling of $10,000.

The reimbursement application should be submitted via the application portal of the Scheme (https://www.greentalent.org.hk/auth/login) within 3 months from the date of completion of the Eligible Programme.

For details, please visit the Scheme website: www.greentalent.org.hk,

or contact the Scheme enquiry hotline: 852-2258-6000,

or email to [email protected].

The Pilot Green and Sustainable Finance Capacity Building Support Scheme reserves the final decision-making authority on all matters and disputes.

About the Course

Course Time: 10:00 - 13:00; 14:00 - 17:00

Enrolment: 6 Jun - 31 Aug 2024

Commencement: 28 Sep 2024

Course Schedule

Class Schedule: 28 Sep, 12 Oct, 19 Oct, 26 Oct, 2024

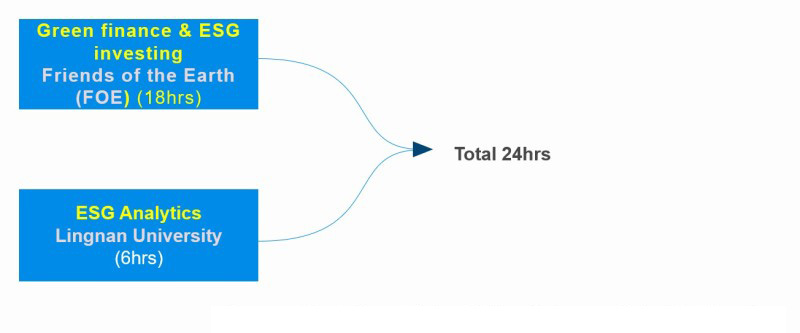

Total Duration: 8 lectures with a total of 24 hours (3 hours per lecture)

Assessment Method

Part A: Individual or group case study to assess understanding of ESG Statistic Analysis, Machine Learning, Risk Analysis Techniques and Big data analytics concepts (50%).

Part B: Assessment of Multiple choice on Green finance & ESG investing (50%).

Completion Requirements: final score is no less than 50 based on the calculation: (Part A+ Part B) /2 (Out of 100 for each part)/2; And class participation and attendance no less than 70%

Course Language

English, Cantonese

Mode of Study

Face to face

Venue

Lingnan@WestKowloon (M+, West Kowloon Cultural District, 38 Museum Drive, Kowloon)

or

Lingnan Union Park Centre (771-775 Nathan Road, Prince Edward, Kowloon)

(To be confirmed)

Course Structure

Supported by: Pilot Green and Sustainable Finance Capacity Building Support Scheme

Course Syllabus

Lecture-1: Global Trends in Development & Regulatory in ESG & Sustainable Finance

- Trends in ESG Development Around the World

- Market Drivers & Barriers to ESG

- ESG and Financial Performance

- Sustainability Regulatory TrendsImpact of EU Regulations on Corporate

- International Regulatory Trends

- Fundamentals of Green & Sustainable Financing

- Definition of Green & Sustainable Finance

- Common Green Financial Products and Services

- Fundamentals of Green & Sustainable Finance in Banking and Lending

- Principles for Responsible Banking

- Green Banking Products and Services

- International Principles for Green and Sustainable Loan and Bond

Lecture-2: ESG Investing & Responsible Banking

- Green and Sustainable Investing

- Definitions and Developments of ESG Investment

- ESG Investment Strategies

- Green and Sustainable Products and Instruments

- Introduction of Responsible Banking and Lending

- ESG application across Individual Asset Classes

- Sustainable Financing frameworks, instruments and evaluation

Lecture-3: ESG Reporting, Disclosures & Taxonomy

- Global Reporting Standards

- Reporting Frameworks and Disclosure – Voluntary and Mandatory

- TCFD&ISSB

- SASB Materiality Assessment & GRI Sustainability Reporting

- Integrated Reporting, Impact Measurement, and Reporting

- Global Footprint and Carbon Accounting

- Data Source

- Quality

- Coverage

- Limitations & Best Practices

- Concept of Materiality

Lecture-4: Global Sustainable Finance and Carbon Markets Development

- GSF Markets and Trends in HK, the Greater Bay Area and around the World

- Introduction of ESG in Asia Pacific

- Regulatory Framework in Asia

- Country Analysis in Asia Pacific

- Introduction to Global Carbon Markets

- Fundamentals of Carbon Pricing & Trading

- Latest Development of Global Carbon Markets

- Applications for Financial Institutions and Corporates

Lecture-5 ESG Asset Valuation and ESG Fundamental Analysis

- ESG Asset Valuation Basics

- Introduction of ESG Valuation Model

- Basic Valuation Model in Equities, Fixed Income and Infrastructure

- ESG Integration into Fundamental Analysis

- Investment Guidelines

- Research and Asset Allocation

- Corporate Analysis

- Portfolio Management

- Ownership and Engagement

- Performance Attribution & ESG Quality

- ESG Integration

- ESG value Identification

- Analysis of ESG

- Controversies and ESG risk litigations

- Consistency with the Business Model

Lecture-6: ESG Development in Asia Pacific Region & Case Study for ESG Integration

- How Banking and Finance contribute to low-carbon transition to a sustainable economy

- Banking Industry sustainability strategy & practices

- Investment Institutions

- Case Study for ESG Integration

- Practice Case Study

- Case Analysis

Lecture-7: A Comprehensive Review on ESG AI & Analytics, Machine Learning for Sustainable Business

- Introduction to AI and ESG Analytics

- Fundamentals of artificial intelligence and its applications in the sustainability context. E.g. machine learning (supervised, unsupervised learning), the role of AI for ESG

- Leveraging geospatial technology for ESG goals and TNFD compliance

- Understanding geospatial data and its analysis tools

- Growing reliance on geospatial data (i.e. satellite-based data, smart sensors, eDNA) for ESG analysis and sustainability

- The role of geospatial technology in TNFD framework

- Machine Learning and Deep Learning Techniques for ESG

- Supervised learning techniques for ESG data analysis (e.g., regression, classification) and predictive modelling/forecasting of ESG KPIs, Unsupervised learning methods for ESG pattern discovery and anomaly detection

- Deep Learning: introduction of Convolutional Neural Networks (CNNs) for ESG image and visual analysis and Recurrent Neural Networks (RNNs) & Long Short-Term Memory (LSTMs) for ESG time series forecasting

Lecture-8: Neural Network and Generative AI (G-Ai) for ESG Reporting and Communication

- Module 6: ESG KPIs Formulae, Analysis & Practical Application

- Defining and calculating key ESG performance indicators (ESG KPIs), formulas and methodologies for ESG KPI calculation, Interpreting and benchmarking the KPIs with different industries/sectors. ESG KPIs for different listed companies with different materiality requirement across industries/ sectors

- Natural Language Processing (NLP) for ESG-related text analysis and processing

- Ethical considerations & limitations of Generative AI in ESG

- Generative-Ai (G-Ai) Assisted ESG Report Generation, Comparison & Benchmarking

- G-Ai assisted ESG report generating and comparing with compliance requirement

- G-Ai assisted ESG Responsible Investing and Financing with development of ESG-focused investment strategies and portfolios

- ESG Case Study: Leverage Generative AI for ESG Reporting, Green Financing & Investing

Course Calendar

(to be released)

Course Lecturers

Professional instructors from commerce/business (CESGA and/or CFA holder) and data analytics sectors:

Dr. Stan Ho (CESGA)

Ms. Karen Ho (CESGA)

Ms. Karen Li (CESGA, CFA)

Mr. Alan Lau (CESGA, CFA)

Prof. Paulina Wong (Lingnan University)

Dr. Ir. Rosiah Ho, CEng, CPEng, RPEng (Lingnan University)

Course Fee and Application

Course fee: up to HKD 9,800*

(reimbursable fees under the Pilot Green and Sustainable Finance Capacity Building Support Scheme)

* Full-time student refers to a student studying a full-time course offered by a recognised educational institution as of the date of application.

**Reimbursement amount is dependent on the actual amount incurred by the programme participant and the applicable percentage of reimbursement based on that participant’s applicant category.

^ Need help with the schedule? Please get in touch with us at [email protected] for assistance.

The Scheme provides training subsidies to Hong Kong residents who are market practitioners and prospective practitioners of green and sustainable finance, namely students and graduates in relevant disciplines.

After completing Eligible Programmes, applicants can apply for a subsidy of up to 80% of the relevant fees (full-time student applicants can apply for a subsidy of up to 100% of the relevant fees), subject to a ceiling of $10,000.

The reimbursement application should be submitted via the application portal of the Scheme (https://www.greentalent.org.hk/auth/login) within 3 months from the date of completion of the Eligible Programme.

Programme Name | Programme Identification Code | Effective Date Under the Scheme* |

Executive Certificate in Sustainable Finance & ESG Analytics | GTP-254234 | 2024/03/05 |

Application Method

Click here

Certificate

Enquiry:

e-mail: [email protected]